45 are treasury bills zero coupon bonds

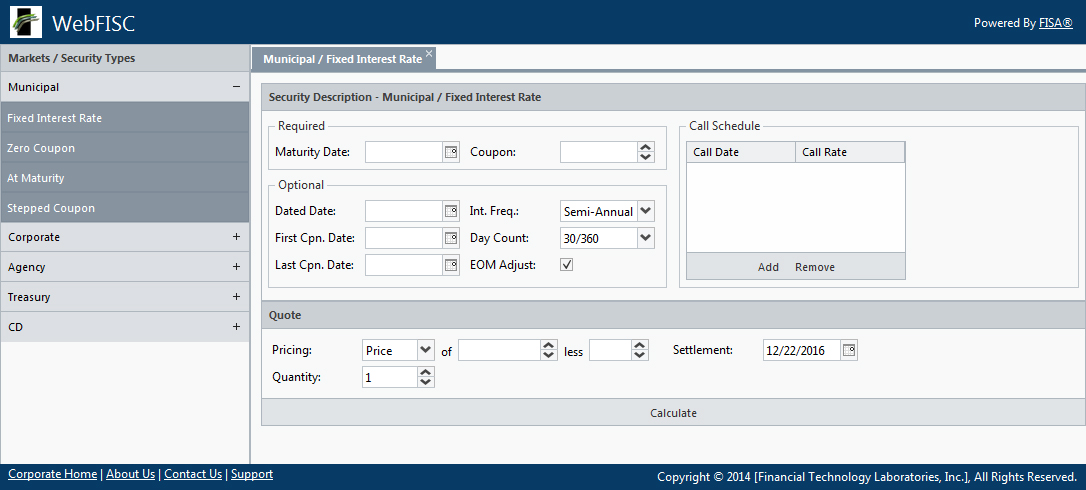

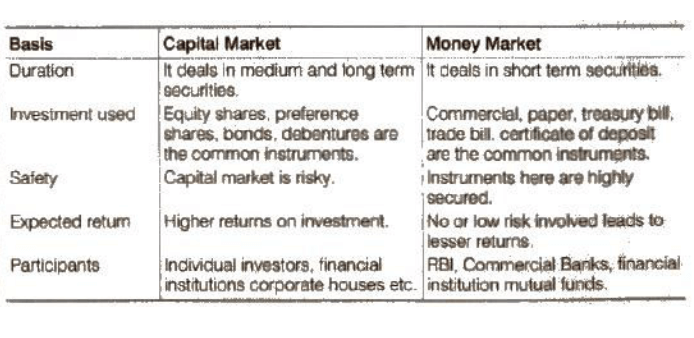

Treasury Bonds | CBK 12-year fixed coupon, treasury bond issue no. ifb 1/2009/12: 29/12/2008: two-year fixed coupon discounted treasury bond issue fxd 4/2008/2: 24/11/2008: one year zero coupon, treasury bond issue zc 3/2008/1: 27/10/2008: five-year fixed coupon discounted treasury bond issue fxd 4/2008/5 : 29/09/2008: ten-year fixed coupon discounted treasury bond ... Tax Treatment of Bonds and How It Differs From Stocks U.S. Treasury issues are notes and bills that generate a federal income tax liability. They aren't subject to state or local income taxes. 2 Municipal bonds (sometimes known as "munis") are tax-free at the federal level. If you buy them in the state where you live, they can be free of state and local taxes as well.

Investing in Treasury Bills: The Safest Investment in 2022 Most bonds are usually issued with a face value of $100 or $1,000. By comparing the present value of the T-bill to its face value, an investor knows whether the bond is overvalued or undervalued. Coupon — The coupon states how much interest the bond will pay. Bonds usually pay this interest semi-annually.

Are treasury bills zero coupon bonds

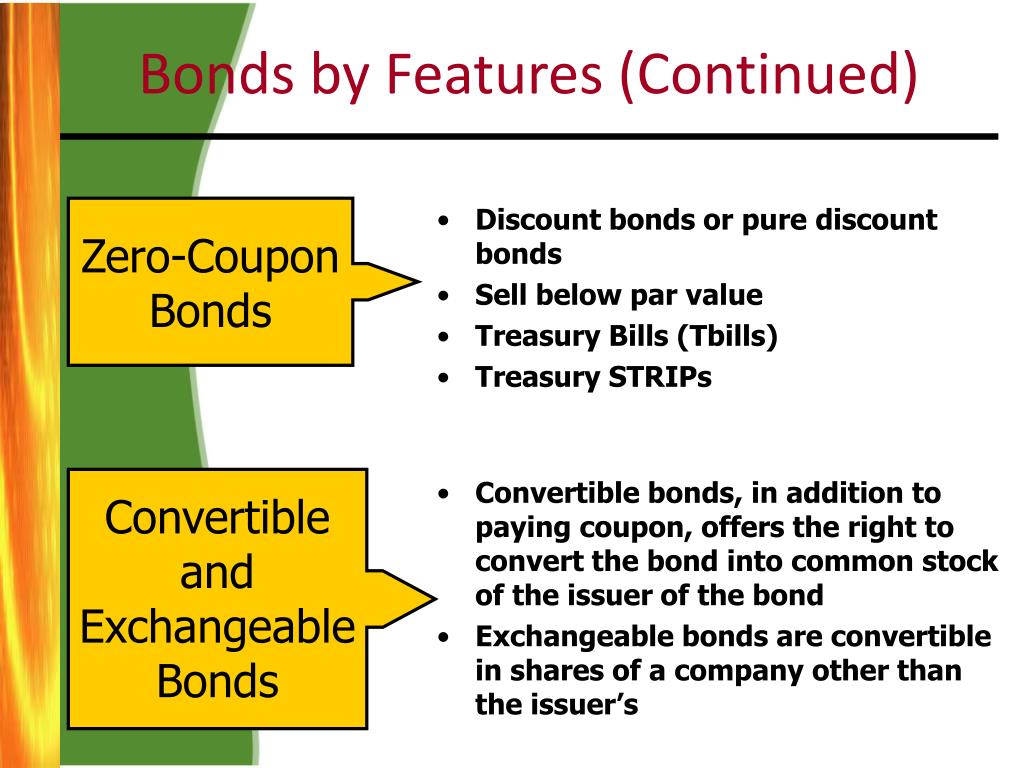

Treasury Inflation-Protected Securities (TIPS) Definition Suppose an investor owns $1,000 in TIPS at the end of the year, with a coupon rate of 1%. If there is no inflation as measured by the CPI, the investor will receive $10 in coupon payments for that... Meaning, Types & Examples of Government Securities in India Bonds issued to the public at a discount on face value but redeemed at par are zero-coupon bonds. These were first issued on January 19, 1994. These bonds have a fixed maturity period. The difference between the discounted rate at face value and the redeemable amount at par acts as the return on investment. Partly Paid Stocks: 38 yield of zero coupon bond The holder of a zero coupon receives the par amount of the particular term of the zero that she holds. For example, an investor holding $100,000 par amount of the December 1, 2001 coupon would receive $100,000 on that date. Conceptually, a zero coupon security is just like a treasury bill or "T-Bill."

Are treasury bills zero coupon bonds. Domestic bonds: South Africa, Bills 0% 4may2022, ZAR (14D) Domestic bonds: South Africa, Bills 0% 4may2022, ZAR (14D) Download Copy to clipboard Zero-coupon bonds, Bills Issue Issuer M - *** * *** S&P - *** * F - *** * *in local currency ***last update 04/04/2022 Status Outstanding Amount 1,150,000,000 ZAR Placement *** Early redemption *** (-) ACI on *** Country of risk South Africa Current coupon *** % Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... Lowest Risk Bonds: Which Investment Has the Least Risk? 2. Treasury Bills Treasury bills (T-bills) are short-term bonds that mature within one year or less from their time of issuance. T-bills are sold with maturities of four, eight, 13, 26, or 52 weeks. Because the maturities are so short, they often offer lower yields than those available on Treasury notes or bonds. Types of Bonds with Durations and Risk Levels The most important bonds are the U.S. Treasury bills, notes, and bonds issued by the Treasury Department. They are used to set the rates for all other long-term, fixed-rate bonds. The Treasury sells them at auction to fund the operations of the federal government. These bonds are also resold on the secondary market.

Treasury Bills (T-Bills) Definition T-bills are zero-coupon bonds that are usually sold at a discount and the difference between the purchase price and the par amount is your accrued interest. How Can I Buy a Treasury Bill? U.S.... Interest rates - Norges Bank Zero coupon yields - data. Treasury bills are government securities, with an original maturity of less than one year. A bond is an interest-bearing security with an original maturity of more than 1 year. Synthetic yield series. The last update of the synthetic yield series for both Treasury bills and government bonds was on 30 June 2021. From 1 ... EGP T-Bonds Zero Coupon EGP Treasury Zero Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 1.5. Auction date. 18/04/2022. Issue date. 19/04/2022. How to Short Bonds - Short Selling U.S. Treasury Bonds a ... For example, Bill Gross, a famous bond trader, is currently short-selling U.S. Treasuries because he and other analysts believe the U.S. government is at a relatively high risk of default. Institutional and foreign demand for bonds is declining. Most bonds are sold to large institutions and foreign governments.

Understanding Zero Coupon Bonds - Part One Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value U.S. Treasury Bonds, Bills and Notes: What They Are and ... Investors in longer-term Treasurys (notes, bonds and TIPS) receive a fixed rate of interest, called a coupon, every six months until maturity, upon which they receive the face value of the bond.... United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 1.913% yield.. 10 Years vs 2 Years bond spread is 32.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.75% (last modification in March 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 11.41 and implied probability of default is ... I Bonds Rates Will Increase To 9.62% (May 2022 Update ... Ninja Note 11/1/21: The fixed interest rate is set again at 0%, which means the interest rate on I Bonds is 7.12% if you buy before the end of April 2022. Every six months, your I Bonds rates will adjust. The fixed rate will always stay at the same rate at the time of your purchase, while the variable rate will be based on inflation changes.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Netherlands Government Bonds - Yields Curve The Netherlands 10Y Government Bond has a 1.227% yield.. 10 Years vs 2 Years bond spread is 87.2 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016).. The Netherlands credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.60 and implied probability of default is 0.18%.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Domestic bonds: Philippines, Bills 0% 16jun2021, PHP (364D ... Domestic bonds: Philippines, Bills 0% 16jun2021, PHP (364D) PIBL1220F245 {{changeWatchlistLinkTitle()}} Copy issue information to clipboard . Copy issue information to clipboard Copy. Download ... Zero-coupon bonds, Bills ...

Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What ... Treasury bonds, notes, and bills have zero default risk since they're guaranteed by the U.S. government. Investors will receive the bond's face value if held to maturity. However, if sold before...

Zero Coupon Bond Definition and Example | Investing Answers Investors can purchase zero coupon bonds from places such as the major exchanges, government entities (such as the U.S. Treasury), and private corporations. The return is based on the difference between the value and purchase price of the bond. Payment is typically made semiannually, which includes both the principal and 'implied interest' earned.

Nigeria Government Bonds - Yields Curve Nigeria Government Bonds - Yields Curve. The Nigeria 10Y Government Bond has a 11.478% yield. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 11.50% (last modification in September 2020). The Nigeria credit rating is B-, according to Standard & Poor's agency.

Foreign Investors Bought Just Over Half of All Russia's OFZ Bonds Issued in Q1 2019 - The Moscow ...

Domestic bonds: Egypt, Bills 0% 2may2023, USD (364D ... Domestic bonds: Egypt, Bills 0% 2may2023, USD (364D) EGT998025N28 Download Copy to clipboard Zero-coupon bonds, Bills Issue Issuer M - *** * *** S&P - *** * F - *** * *in foreign currency ***last update 30/07/2021 Status Outstanding Amount 1,016,800,000 USD Placement *** Early redemption *** (-) ACI on No data Country of risk Egypt Current coupon

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Treasury Bond Quotes | US Treasury Bond Rates ... Avoiding The "Unrepresented Tax" Could Save $1.6M in Taxes within Four YearsApril 29, 2022. Via Marketers Media. Topics Economy. Exposures Interest Rates. Prepaidify: Buying Gift Cards with Ethereum, Bitcoin, Dogecoin, and Cryptocurrencies is Easy.

38 yield of zero coupon bond The holder of a zero coupon receives the par amount of the particular term of the zero that she holds. For example, an investor holding $100,000 par amount of the December 1, 2001 coupon would receive $100,000 on that date. Conceptually, a zero coupon security is just like a treasury bill or "T-Bill."

Meaning, Types & Examples of Government Securities in India Bonds issued to the public at a discount on face value but redeemed at par are zero-coupon bonds. These were first issued on January 19, 1994. These bonds have a fixed maturity period. The difference between the discounted rate at face value and the redeemable amount at par acts as the return on investment. Partly Paid Stocks:

Treasury Inflation-Protected Securities (TIPS) Definition Suppose an investor owns $1,000 in TIPS at the end of the year, with a coupon rate of 1%. If there is no inflation as measured by the CPI, the investor will receive $10 in coupon payments for that...

Post a Comment for "45 are treasury bills zero coupon bonds"