45 what is meant by coupon rate

› gold-rateToday Gold Rate: 22 & 24 Carat Gold Price in India: 19 June 2022 Jun 17, 2022 · Today Gold Rate (19 June 2022) : Get Current / Today's 22 Carat & 24 Carat Gold Price in India based on rupee per 1 gram & 10 gram. Also know last 10 days gold price, trend of gold rate & comparison of 22 & 24 Karat across various cities in India including Delhi, Bangalore, Chennai, Hyderabad & Mumbai etc. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

› terms › dDiscount Rate Definition - Investopedia Aug 29, 2021 · Discount Rate: The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

What is meant by coupon rate

What Is a Stock-Up Price? - The Krazy Coupon Lady Here at KCL, we pair hot, new coupons with popular retailers—like Target, Walmart and Costco—and report the hottest final prices to you, our readers. Most of the 60+ deals we share every day feature at least 30-50% savings on hot name brands. Definition of Bond Discount Rate - Pocketsense The discount rate is used to create a present value factor, which is applied to the payment of streams. For example, if a $100 bond is a zero-coupon, one-year bond paying 10 percent interest, the only payment made is the repayment of the $100 principal plus $10 in interest. This occurs at the end of year 1. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward.

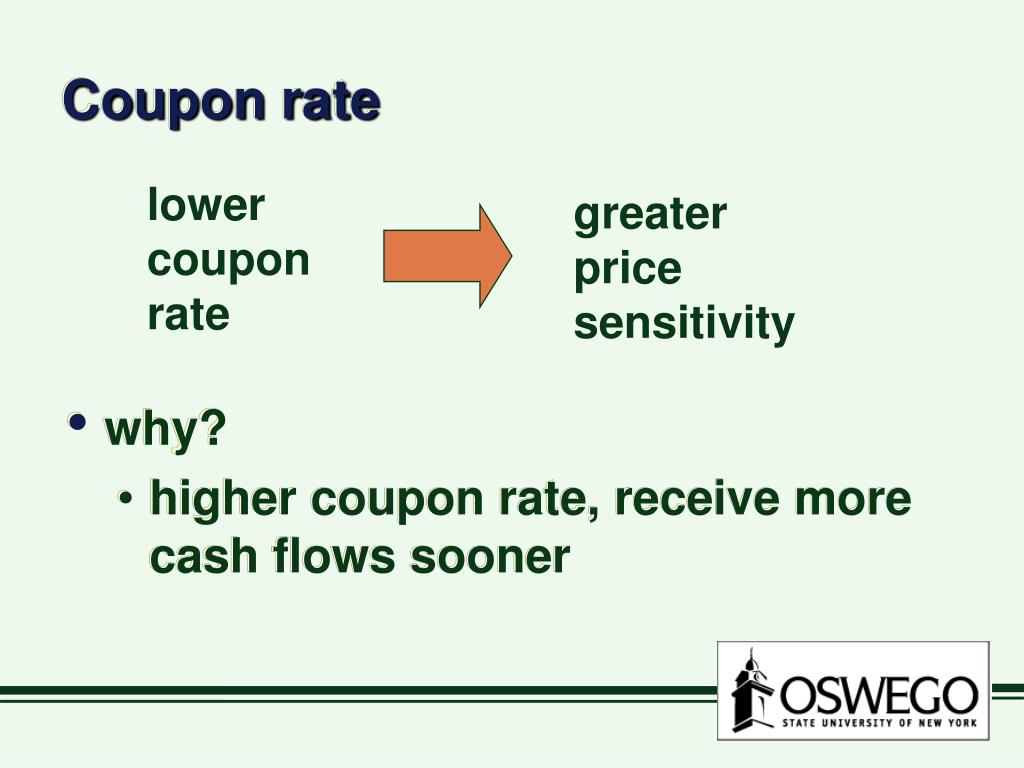

What is meant by coupon rate. Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is the rate of interest that is paid on the bond's face value by the issuer. The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100

Prime Rate | Current Prime Rate | What It Is & How It Works The prime rate is the interest rate major banks offer to their borrowers with the best credit — in other words, the least risky ones. This key benchmark jumped for the third time this year, after the Federal Reserve increased its policy rate by three-quarters of a percentage point to try to quell runaway inflation.. The two rates move together, and the new increase means higher borrowing ... › dictionary › couponCoupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence. What Is Discount Rate and Why Does It Matter? - SmartAsset The discount rate is a financial term that can have two meanings. In banking, it is the interest rate the Federal Reserve charges banks for overnight loans. Despite its name, the discount rate is not reduced. In fact, it's higher than market rates, since these loans are meant to be only backup sources of funding. Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest … › jewellery › gold-rateGold Rate Today in India | 22K & 24K Gold Price in India Jun 19, 2022 · Today's Gold Rate in India: Get live 22 & 24 karat gold price in India per 1 gram & 10 grams. Know last 10 days 916 gold rate in India. Avail the lowest cost EMI on any purchase. Basics Of Bonds - Maturity, Coupons And Yield A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year, semi-annually.

Bond Definition: What Are Bonds? - Forbes Advisor Coupon: The fixed rate of interest that the bond issuer pays its bondholders. Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the ...

What is a Current Coupon? (with picture) - wiseGEEK A coupon is the interest payment on a loan, and current refers to an instrument that is at the going market rate. Taken together, this means that the current coupon mortgage backed security has the interest rate that most accurately reflects the current state of the market.

J.B. Dillon - We make western style boots by hand, shipped to your … Rate our boots on Google. OUR BEST-SELLING MEN’S BOOT. Chambers. This durable, soft ostrich quill leather boot features a functional 1.5″ heel, and comes in three different colors for any style. You’ll love slipping the Chambers boots on from the day you get them, to ten years from now. PICK YOUR COLOR. FALL IS HERE. Chicory. Exotic and fierce, our Chicory women’s …

Discount Rate Definition - Investopedia 29/08/2021 · Discount Rate: The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

WEBM to GIF (Online & Free) — Convertio WebM is meant to be an alternative to the h.264 standard. The copyright of the extension is held by Google. more info. GIF Converter. gif. Graphics Interchange Format. GIF is a format for the exchange of images. It is a popular format graphics. Capable of storing compressed data without loss of quality in the format of not more than 256 colors. GIF format was developed in 1987 …

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure.

Federal Discount Rate Definition - Investopedia 25/07/2021 · Federal Discount Rate: The federal discount rate is the interest rate set by the Federal Reserve on loans offered to eligible commercial banks or other depository institutions as a …

roblox.fandom.com › wiki › TicketTicket | Roblox Wiki | Fandom Not to be confused with support tickets. Tickets, better known and shortened as Tix were a form of currency on Roblox, introduced on August 2, 2007. Tix was earned by players through various methods, including visiting the site daily and having other users visit their Place. Tix could be spent on Catalog items and on advertisements. They were mainly used to buy things from the catalog. At the ...

How the Fed's rate increase may affect your bond portfolio For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

EPF Interest Rate 2022: How to Calculate EPF Interest Online EPF Interest Rates 2022 – 2022. The interest rate on EPF is reviewed on a yearly basis. The EPF interest rate for the fiscal year 2022-23 is 8.10%. When the EPFO announces the interest rate for a fiscal year and the year closes, the interest rate is computed for the month-by-month closing balance and then for the entire year.

What Is Market Price of a Bond | Bond Prices | India The rate used to discount the future cash flows to the present value is YTM rate. Exponential values are calculated using an exponential calculator Example 1: Market price of a bond with a face value of ₹100, YTM of 6.085%, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, will be ₹110 MARKET PRICE TERMINOLOGY

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate.

Treasury Inflation-Protected Securities: FAQs about TIPS TIPS have fixed coupon rates, which are based on the principal value of the security. If inflation rises, that rate is based off a higher principal amount. If inflation rises, so do the coupon payments. The table below provides a hypothetical look at a TIPS principal value and coupon payment based on a constant 3% rise in inflation.

Q&A on TIPS | Treasury Inflation-Protected Securities So, for example, on Jan. 23, 2014, the Treasury auctioned new TIPS with a coupon rate of 0.625% and a yield to maturity of 0.661%. Buyers paid about $99.55 for $100 of value to get a coupon rate of 0.625%, and the resulting yield was 0.661%. On March 20, the Treasury reissued this same TIPS, which still has a coupon rate of 0.625%.

Post a Comment for "45 what is meant by coupon rate"