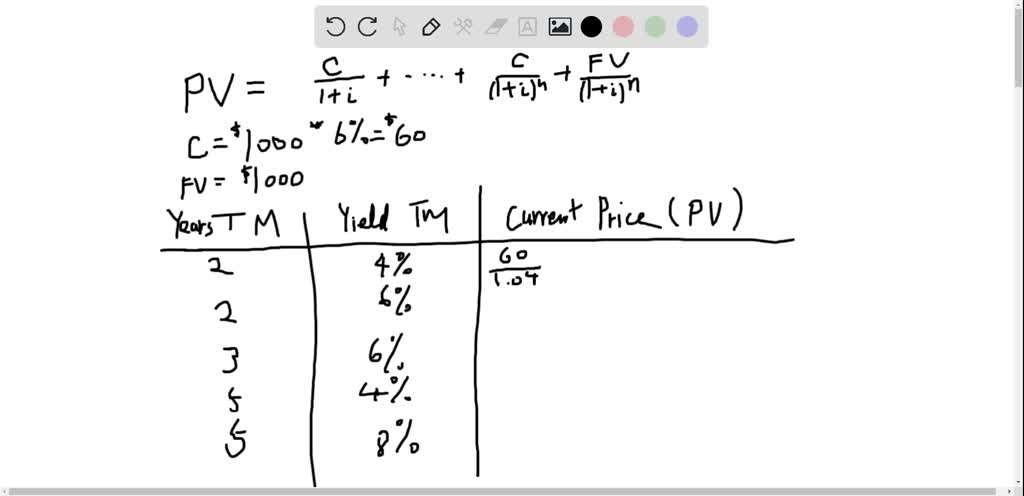

40 price of coupon bond

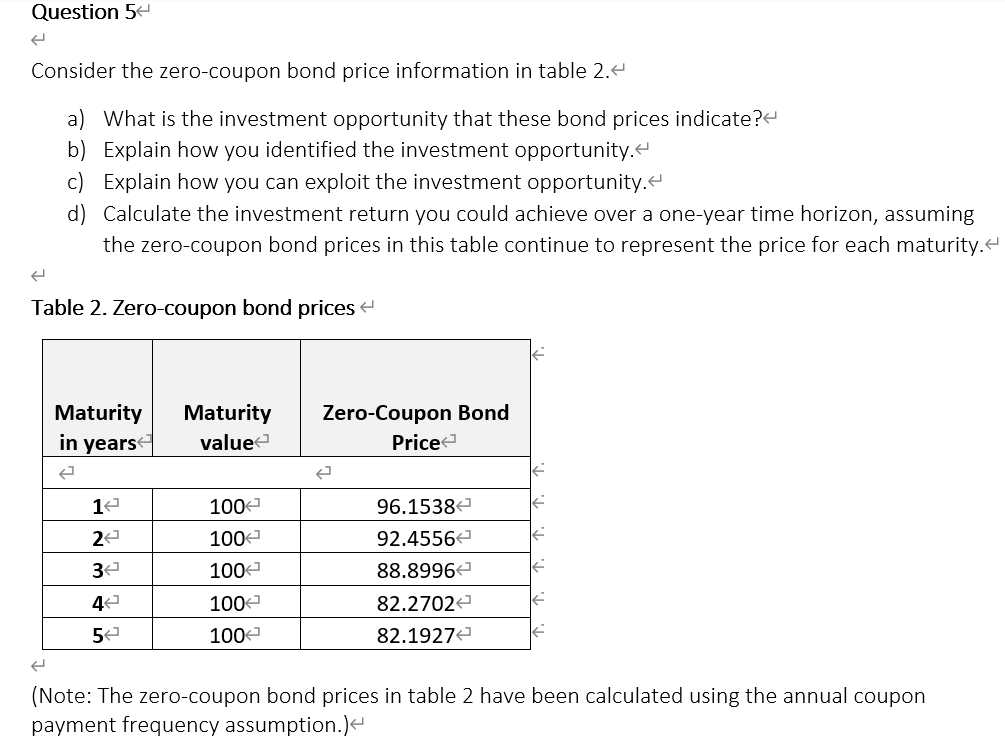

Zero Coupon Bond Value - Formula (with Calculator) - finance … To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% … Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $932 Therefore, the current market price of each coupon bond is $932, which means it is currently traded at discount (current market price lower than par value). Coupon Bond Formula - Example #2 Let us take the same example mentioned above.

Price of coupon bond

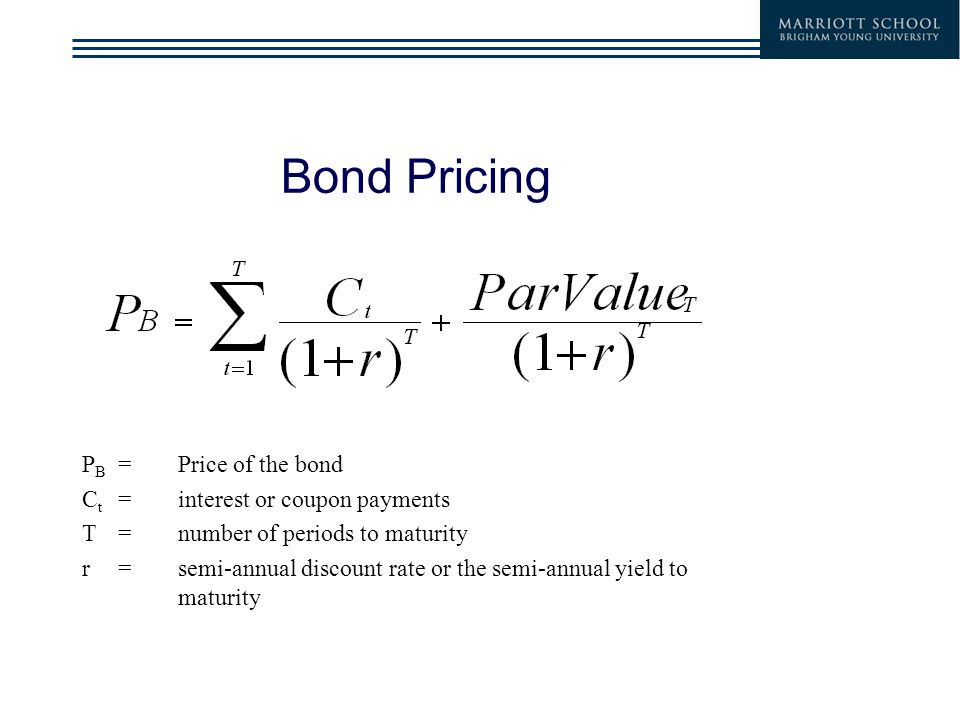

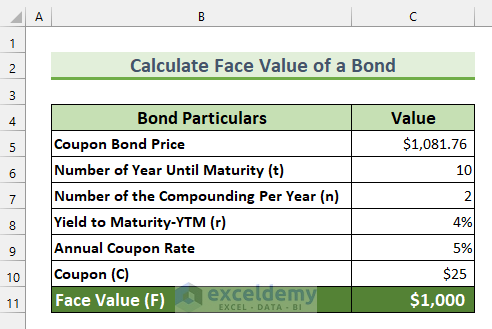

How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) BONDS | BOND MARKET | PRICES | RATES | Markets Insider Get all the information on the bond market. Find the latest bond prices and news. ... The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the ... Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

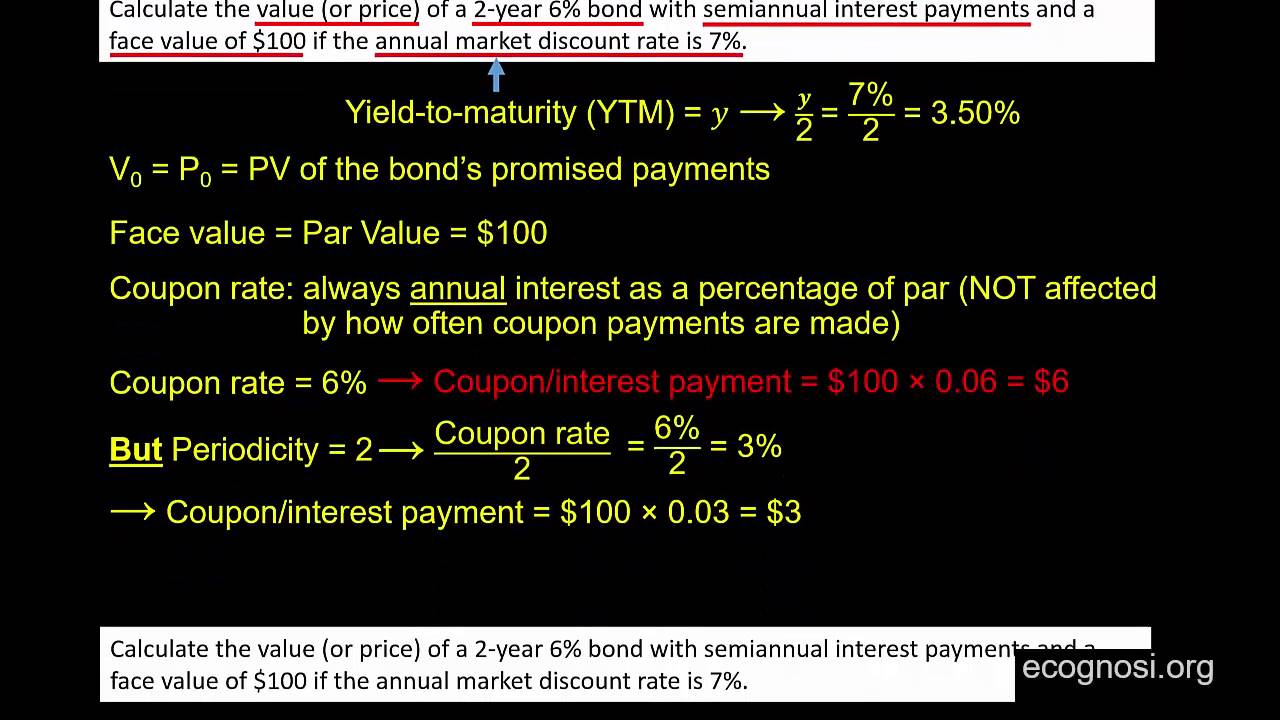

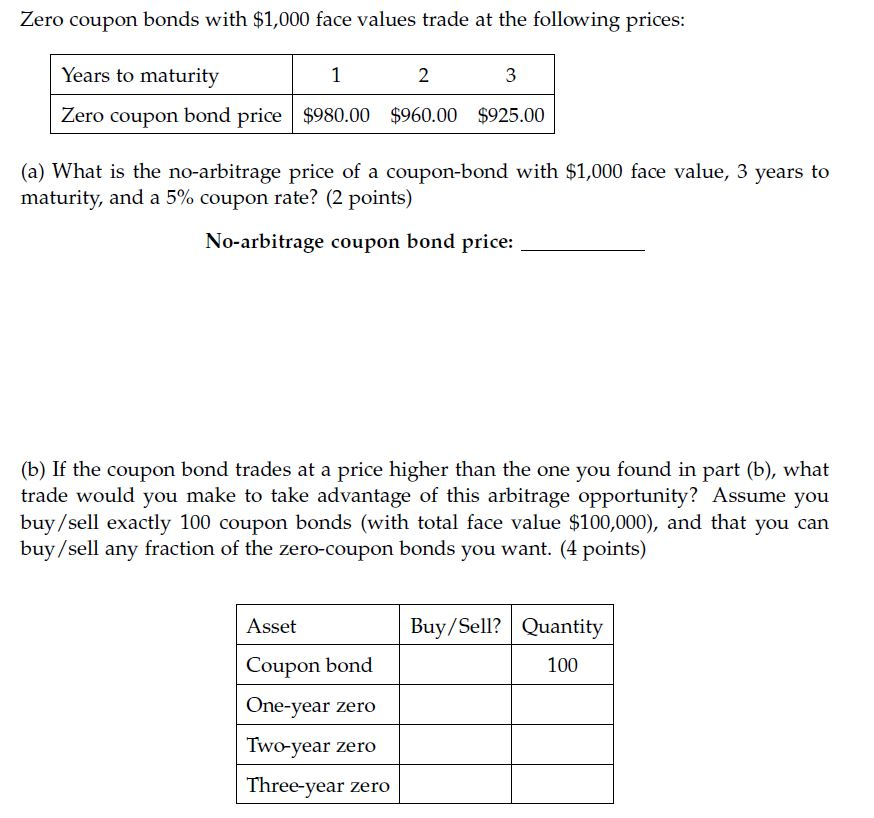

Price of coupon bond. Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled... How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... Find the price of the original bond (coupon rate = 5%, $1,000 face value, discount rate of 6%) if the term to maturity changes to: a. 2 years b. 10 years c. 30 years Solved Bond A has a coupon rate of 10% and a yield of 13%. | Chegg.com Bond A has a coupon rate of 10% and a yield of 13%. Bond B has coupon rate of 5% and sells for the same price as Bond A. Both bonds have the same face value and maturity. From this, which of the followings is the most inappropriate statement? The yield of Bond B is greater than 5%. The yield of Bond B is less than 10%. Forward Price Of A Coupon Bond - Andrew Jacobson This section derives the forward price of a coupon bond and begins with the following example: Forward contract transaction date: November 26, 2001 Underlying security: 100 face amount of the 5.50s of May 15, 2009 Forward date: March 28, 2002. Price of 5.50s of May 15, 2009, for November 27, 2001, settle: 103.6844. Again denoting the forward ... Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay ...

Bond Price Calculator | Formula | Chart 20.06.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the … Calculate Price of Bond using Spot Rates | CFA Level 1 27.09.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. The prevailing ... Bond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Bond Price Today - BOND Coin Price Chart & Crypto Market Cap The current real time Bond price is $0.00, and its trading volume is $0.00 in the last 24 hours. BOND price has plummeted by 0.00% in the last day, and decreased by 0.00% in the last 7 days. It's important to note that current Bond market capitalization is $0.00, Talking about circulating supply, BOND has 0 coins.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

How to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot:

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Coupon Bond - Investopedia Typical bonds consist of semi-annual payments costing $25 per coupon. Coupons are usually described according to the coupon rate. The yield the coupon bond pays on the date of its issuance is...

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

consider a bond with a 6 annual coupon and a face value of 1000 complete the following table what re

BONDS | BOND MARKET | PRICES | RATES | Markets Insider Get all the information on the bond market. Find the latest bond prices and news. ... The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the ...

How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6))

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "40 price of coupon bond"