41 step up coupon bonds

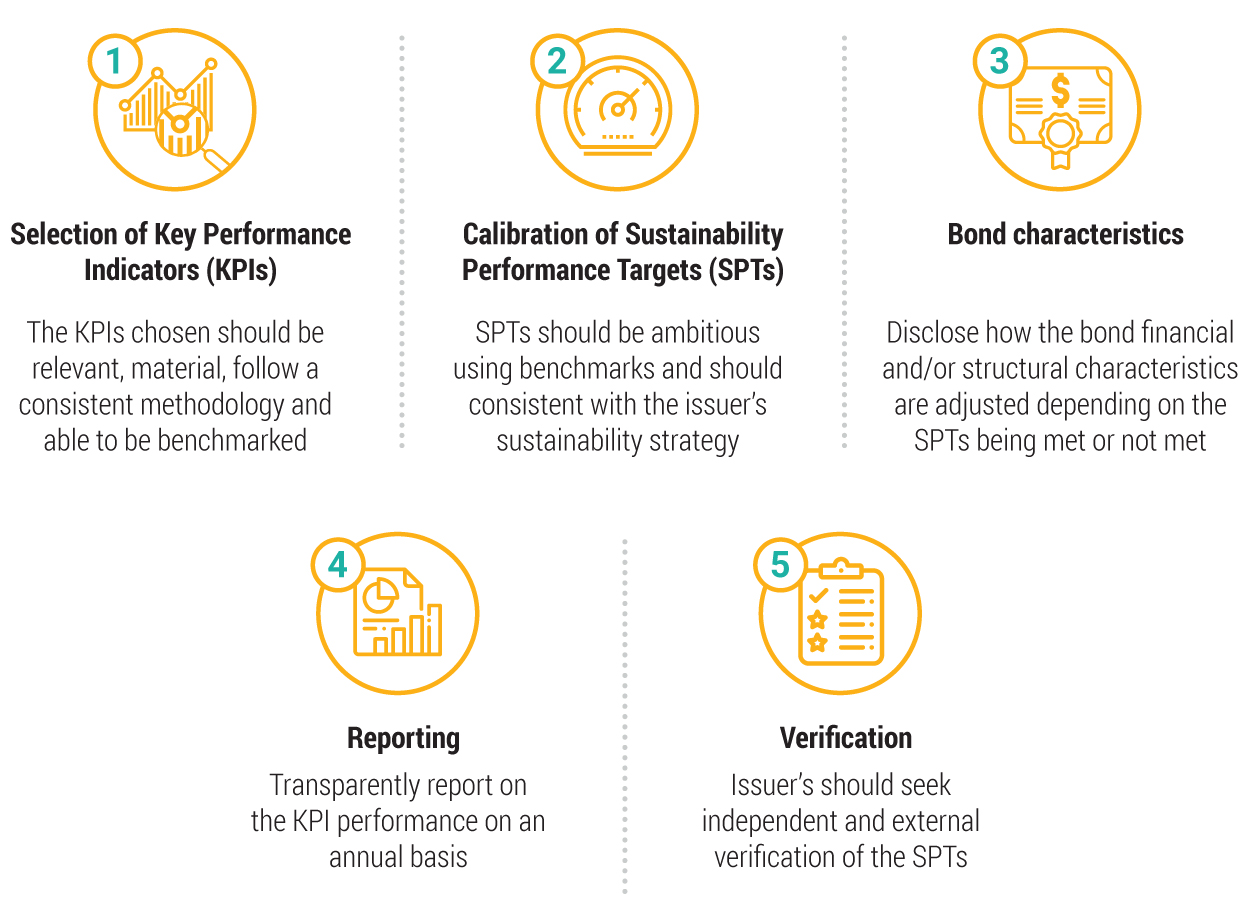

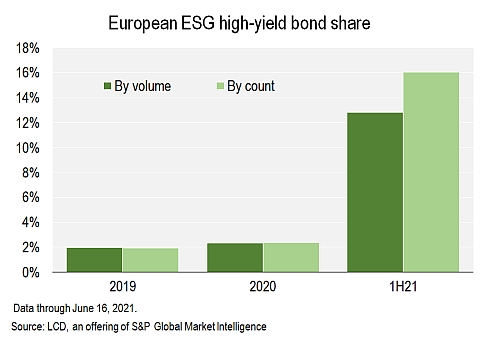

Step-Up Coupon Bond - Harbourfront Technologies What is a Step-Up Coupon Bond? A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases. Do sustainability-linked bonds have a step-up problem? Sustainability-linked bonds (SLBs) have grown rapidly over the last year. The market's preferred mechanism for punitive fees when a company misses sustainability targets is a coupon step-up, most often set at 25bps. Because the flat rate of 25bps doesn't consider the scale of a business, the materiality of this as an incentive is ...

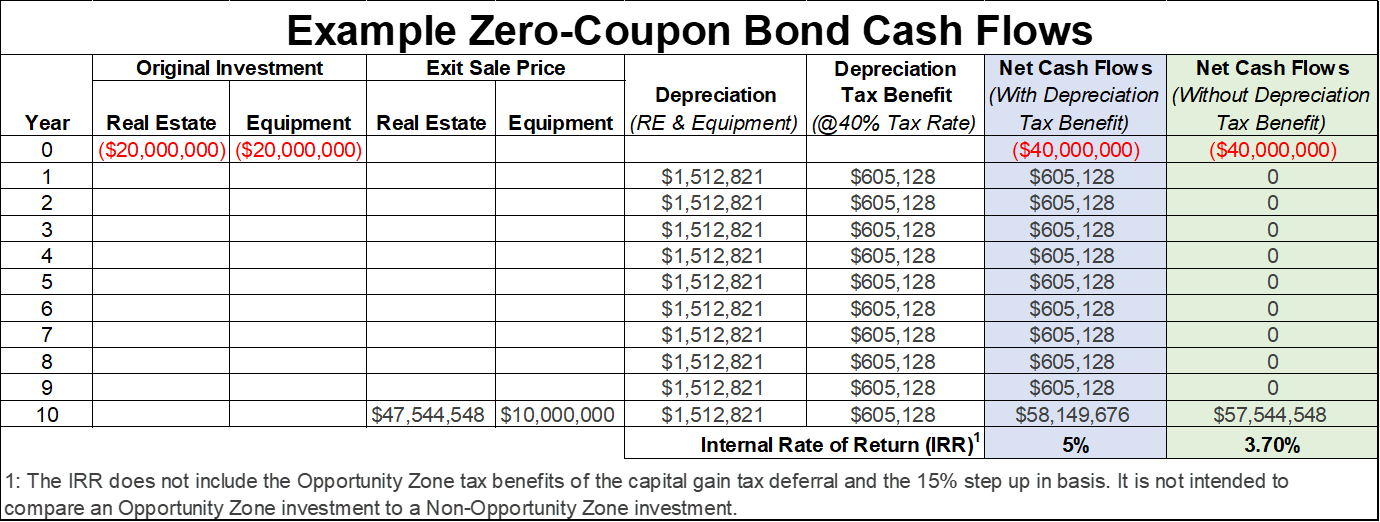

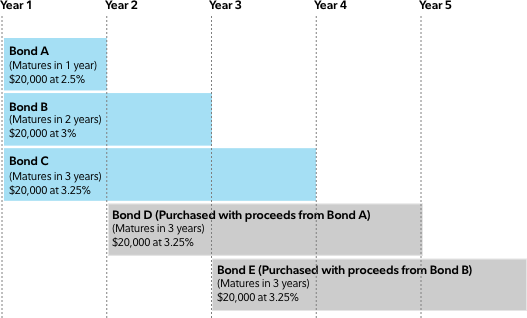

PDF An Analysis of Step-Up Fixed Income Securities The step-ups may not be better than a fixed income bond. If what drew you to the step-up was those big yield numbers, think again. Considerations What are some of the considerations in purchasing these step-up ... Step-Up CD Date- Coupon Rate Actual Yield to Date Actual Yield to Date 01/20/2017 - 2.000% 2018 - 2% 2018 - 1% ...

Step up coupon bonds

Step-Up Bonds Definition & Example | InvestingAnswers What are Step-Up Bonds? A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ. Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond. Novartis stirs debate with first social-linked step-up coupon bond Novartis stirs debate with first social-linked step-up coupon bond. Jon Hay , Mike Turner. September 17, 2020 10:00 PM. Sustainability-linked bonds took a full year to get going after Enel, the ...

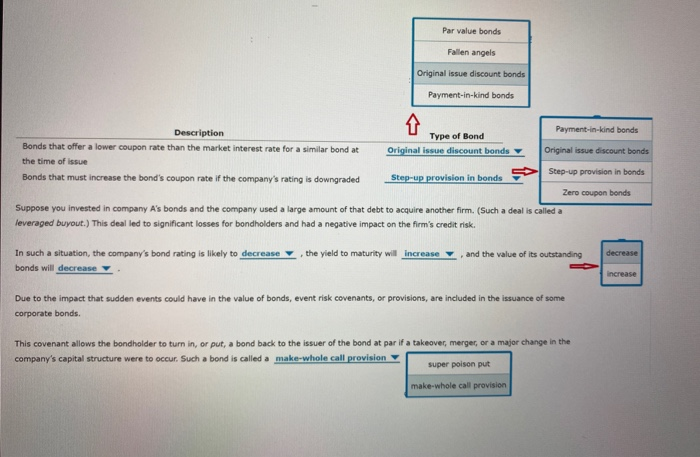

Step up coupon bonds. Coupon Step-up Definition | Law Insider Define Coupon Step-up. On the Distribution Date following the first possible optional termination date, the margin on the Certificates will increase to the following, subject to the applicable Net WAC Pass-Through Rate. Class After Optional Termination ----- ----- A Certificates 2 x Margin Mezzanine Certificates 1.5 x Margin ----- The depositor has filed a registration statement (including a ... Step Coupon Bonds Definition | Law Insider Examples of Step Coupon Bonds in a sentence. The 2015 Series A Serial Bonds and Term Bonds are subject to optional redemption prior to maturity on or after July 1, 2025, and the 2015 Series A Step Coupon Bonds are subject to optional redemption prior to maturity on or after July 1, 2020 at a price of 100%. Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period. Are step-up bonds good protection against rising rates? These are bonds where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series too. These are also called as a dual coupon or multiple coupon bonds. These are just the opposite of Step-Up Bonds. These are bonds where the coupon usually steps down after a certain period.

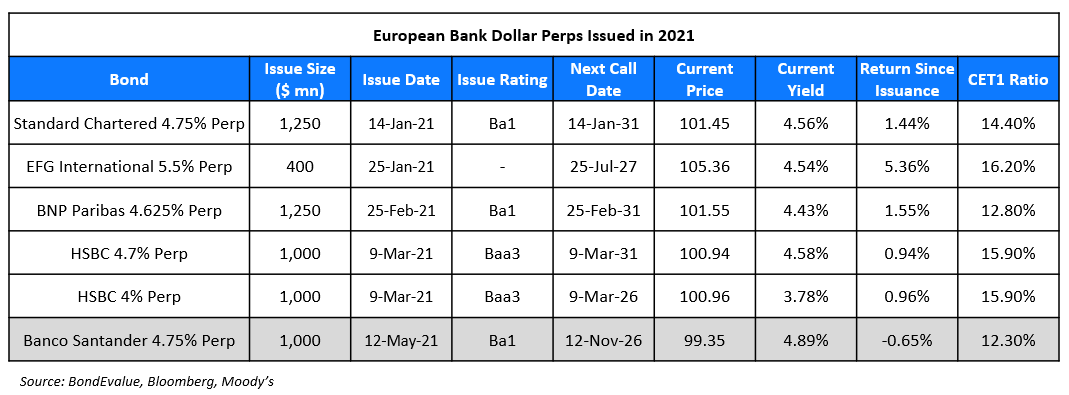

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages To help mitigate the interest rate risk, the issuer of a perpetual bond may offer a step-up feature that periodically increases the coupon rate according to a set schedule. For example, the coupon rate may be increased by a fixed percentage amount once every 10 or 15 years. Step-Up Coupon Securities financial definition of Step-Up Coupon Securities Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Also called dual coupon bond, rising-coupon security, step-up coupon security. Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases...

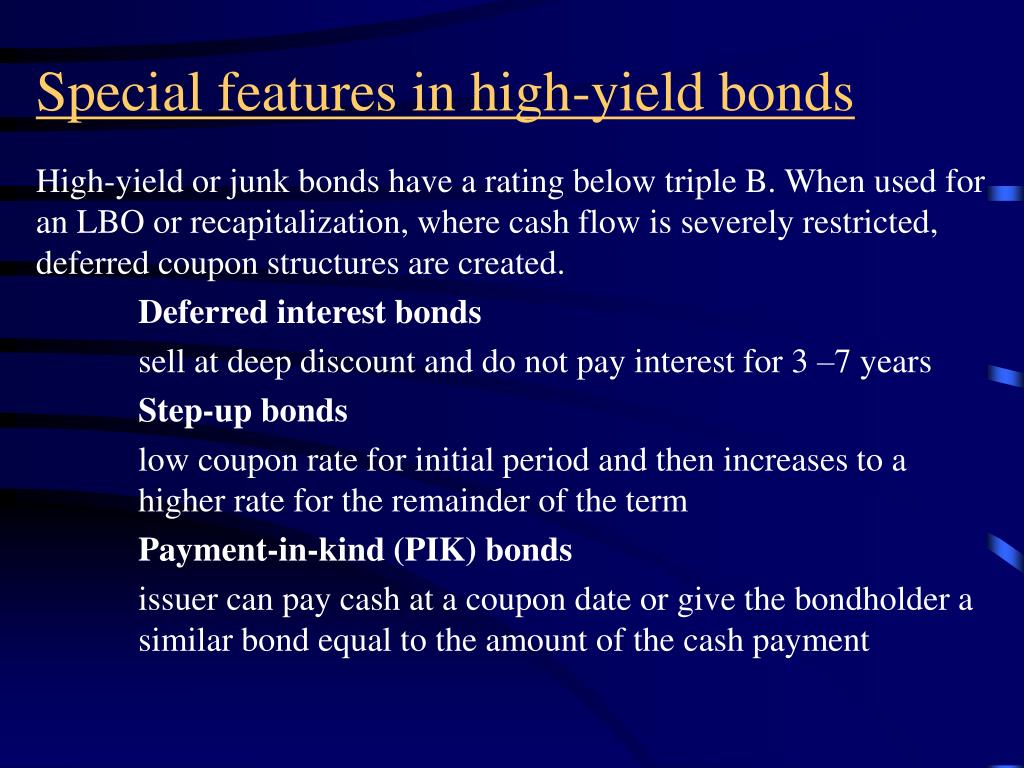

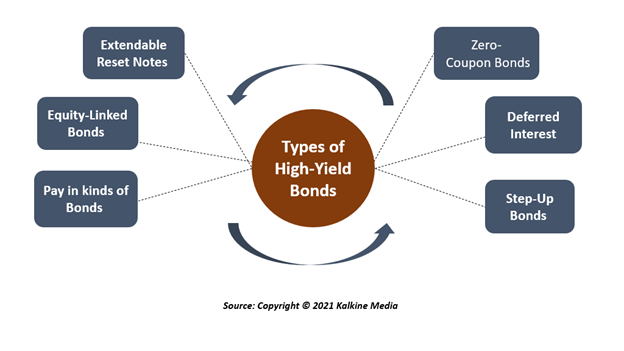

Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 880 Why Step-Up Bonds? | Meaning, Reason, Types, Benefit, etc | eFM Step-up bonds or notes are a type of bond with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year. Step Up Bonds: Pros and Cons - linkedin.com Some of these advantages are mentioned below: Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the... What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

All the 21 Types of Bonds | General Features and Valuation | eFM The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds

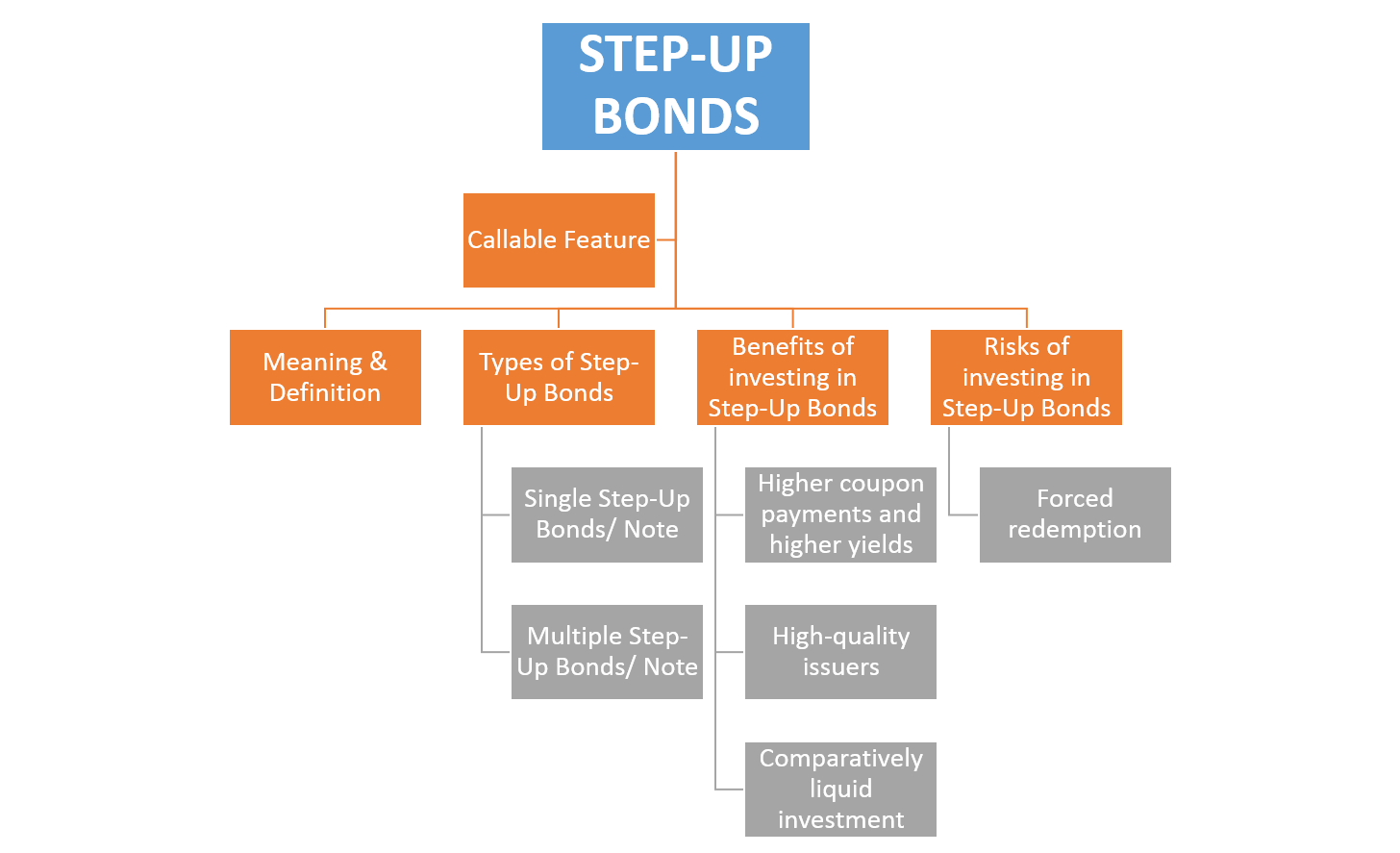

What are Step-up Bonds? Example, Types, Advantages, and Disadvantages The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds

Describe Different Types of Bonds | CFA Level 1 - AnalystPrep Interests fluctuate during the bond's life. FRNs generally have quarterly coupons. Step-up coupon bonds, either fixed or floating, have coupons that increase by specified margins at specified dates. Such bonds provide protection against rising interest rates. Credit-linked bonds have coupons that change in line with the bond's credit rating.

What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second...

What is a Step-Up Bond? - Accounting Hub Step-up bonds are a special type of bond that comes with rising interest rates. These bonds offer a low-interest rate initially and then an increased interest rate after a specific period. It can come with a single interest rate rise or multiple interest rate increases. The interest rates can also be linked with inflation rates.

Accounting for Step-Up Bond | Example | Advantage - Accountinguide Multi Step-up bond is the step-up bond in which the coupon rate increases more than one before the maturity date. Advantage of Step Up Bond. High return for investors: Investors will receive more return by investing in step-up bonds, the interest rate will keep increasing over time. If compared to normal bonds, the step-up bonds will generate ...

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Meaning & Definition Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds

Coupon Bond: Definition, How They Work, Example, and Use Today The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a...

Novartis stirs debate with first social-linked step-up coupon bond Novartis stirs debate with first social-linked step-up coupon bond. Jon Hay , Mike Turner. September 17, 2020 10:00 PM. Sustainability-linked bonds took a full year to get going after Enel, the ...

Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond.

Step-Up Bonds Definition & Example | InvestingAnswers What are Step-Up Bonds? A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "41 step up coupon bonds"